You can use Legal Investment/Trade Financing Agreement or Promissory Note for all Investment and Trade transactions.

BOTH ARE LEGALLY BINDING AGREEMENTS, BUT THEY HAVE A FEW KEY DIFFERENCES:

• A Promissory Note is used for a smaller Investment/Trade Finance with simple repayment terms and usually only includes the signature of the borrower

• An Investment/Trade Finance Agreement has more complex repayment terms and includes the signature of both the borrower and the lender.

Creating written INVESTMENT/TRADE FINANCE AGREEMENTS benefits both the borrower and the lender.

A Promissory Note with Installment Payments specifies and documents the terms of a loan that will be paid back with consistent, equal, payments. You’re a borrower and are agreeing to a loan with installations. You’re in the business of loans or manage a loan company.

A promissory note includes a specific promise to pay, and the steps required to do so (like the repayment schedule), while an IOU merely acknowledges that a debt exists, and the amount one party owes another.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks.Real Estate This is similar to commercial notes in terms of nonpayment consequences.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you’ll need to gather some information and make decisions about the way the loan will be structured. First, you’ll need the names and addresses of both the lender (or “payee”) and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Step 1 Agree to Terms. Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money. Calculating Total Interest Owed. Calculating the Final Payment Amount. Calculating the Monthly Payment Amount.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

INVESTMENT/TRADE FINANCING AGREEMENTS FOR THE BORROWER:

• Helps to track payment schedule

• Confirms that the lender accepts payment terms such as PAY or PROFIT rate

INVESTMENT/TRADE FINANCING AGREEMENT FOR THE CREDIT/INVESTOR:

• Implements owner/borrower’s promise to repay Investment/Trade Finance

• Provides recourse in case the Borrower fails to pay or defaults in Investment/Trade Finance.

Our Legal Investment/Trade Finance Agreement includes the following basic information’s

INVESTMENT/TRADE FINANCE AGREEMENT:

• Investment/Trade Financing amount

• SHARE or PROFIT ratio, ie the Income/Profit or Share ratio that a lender charges the borrower to use his money. Usually expressed as a percentage of principal or project/asset share (eg.. 7% revenue or 30-70% share)

PAYMENT PLAN:

• Duration or length of the contract (eg 3-6…months or one…year)

• Single payment or regular payment option

PAYMENT METHOD:

• One-time payment made on a specific date at the end of the period

• One-time payment up to a specified date at the request of the lender or the investor.

• Regular payments made over a period of time

NON-RESPONDED OR LATE PAYMENTS:

• Increased Income/Profit or Share ratio if Investment/Trade Finance is not paid on time

• Collateral, which is something of monetary value, such as a vehicle or property, that is lost to the lender if the Investment/Trade Finance cannot be paid

• You can use our Promissory Note form for Bonds or Investment/Trade Financing with simpler terms.

• If you are a shareholder, you can use our Shareholder Investment/Trade Finance Agreement to lend money to your company.

• You can send a Letter of Request to Investors and Company Owners to request an outstanding payment.

A sales agreement is a contract where the details of a future sale are agreed on, and all terms required to execute the sale are outlined.

With our sales agreement you can create your own terms and set the price, date of sale, down payment, delivery location, warranty details and more.

Note: The Sales Agreement form is not meant for the sale of real estate, stocks, or shares. If you are selling real estate, please use our Real Estate Purchase Agreement. For the sale of stocks or shares, try our Share Purchase Agreement.

A contract for two or more individuals or entities to form a business relationship suitable for a single project or purpose.

In this case the individual Members will have unlimited liability for the debts and liabilities of the Partnership and the actions taken by other Members on behalf of the Partnership.

A contractual joint venture is tax transparent where there is no pooling of profits or losses and no formal registration requirements.

Further, there may be limited liability provided the joint venture is not deemed a partnership. Where the relationship amounts to a partnership, two or more persons carrying on a business in common with a view to profit, then general partnership rules would apply to each member.

A contract between two or more individuals or organizations to establish a business relationship for a single project or purpose.

In this case, the individual Members will be unlimitedly liable for the debts and obligations of the Incorporation and the transactions made by the other Members on behalf of the Incorporation. Usually the income from a partnership is passed on to the partners. Partners must include this income in their federal adjusted gross income (for individuals) or taxable income (for other taxpayers), although a partnership may still be required to file a tax return.

A contractual joint venture is tax transparent where profits or losses are not pooled and there are no formal registration requirements. There may also be limited liability provided that the joint venture is not considered a partnership. If the relationship is to a partnership, where two or more people run a joint business for profit, the general partnership rules will apply to each member.

A Land Contract, also known as a Title Deed Contract, is used to purchase real estate (real estate where construction is completed).

With a Land Contract, the buyer immediately takes ownership of the property, although the seller usually finances the sale (known as seller financing or owner financing). However, the seller retains title (title) to the property until the buyer pays most or all of the purchase price.

A LAND AGREEMENT MAY ALSO BE KNOWN AS A/AN:

• Title Deed Agreement• Land Sale Agreement

• Land Purchase Agreement• Land Sale Agreement

• Installment Land Contract

What Is Included in a Land Contract?

A LAND CONTRACT CONTAINS INFORMATION ABOUT:

• Sales person

• Buyer

• State where the property is located

• Legal property description (usually found in the title or deed of the property)

• Monthly payment amount, date and interest rate at which buyer should start monthly payment

A LAND AGREEMENT ALSO:

• Seller is aware of property defects such as material and/or structural defects.

• There are liens, costs and/or obligations on the title deed of the property

• Seller or buyer will be responsible for paying property taxes.

When Should You Use a Land Contract?

You must use a Land Contract when the seller (owner of the property) provides financing to the buyer for the purchase of the property. Usually the seller allows the buyer to pay the loan in monthly installments.

PART OF THE INSTALLMENT IN GENERAL:

• Repayment of principal (total Investment/Trade Financing amount)

• Investment/Trade Finance Income or Profits

What Happens If You Default on the Title Deed Agreement?

A Title Deed Agreement will contain a so-called default of purchase clause; This means that the buyer has a right of recourse to the seller if he delays payment or misses’ payment altogether.

A TYPICAL PURCHASE DEFAULT PROVISION MAY SHOW:

• If the buyer pays late, they have time to fix it or a late fee will be charged.

• If the buyer is unable to recover from a purchase default (such as a late payment), he or she will only have a certain amount of time or need to vacate the property to pay the remaining balance of the purchase price.

• If the buyer is able to rectify any defaults that have occurred, the seller may, at its discretion, reinstate the Land Contract.

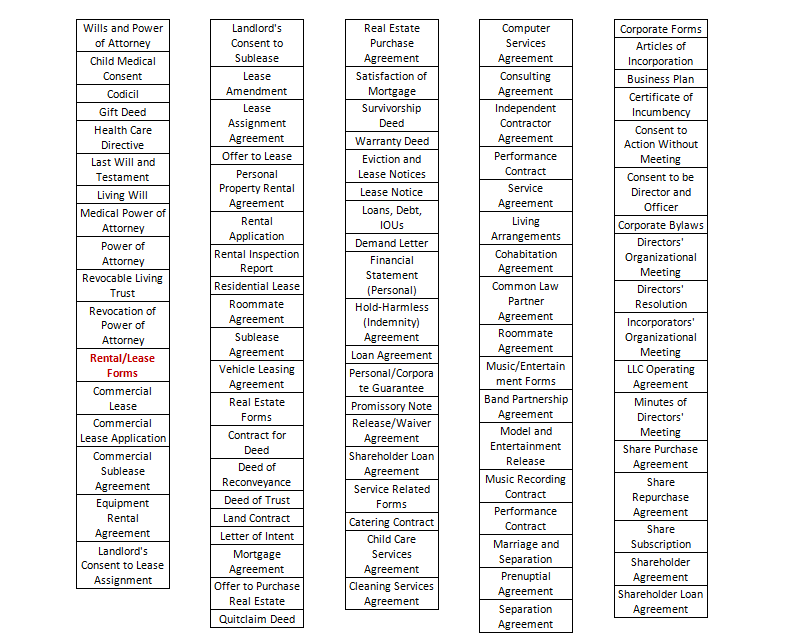

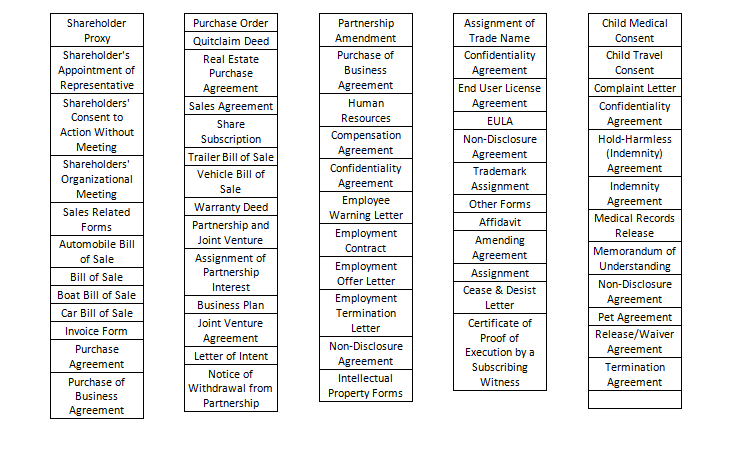

All Documents and Contracts

DISCOUNT CARD SAMPLE

PROMISSORY NOTE SAMPLE