Global Beneficial Financial Planning Investing & Asset Management Platform

Financial Planning and Asset Management of Investing It’s time to make the switch to Ethical and Beneficial Investing

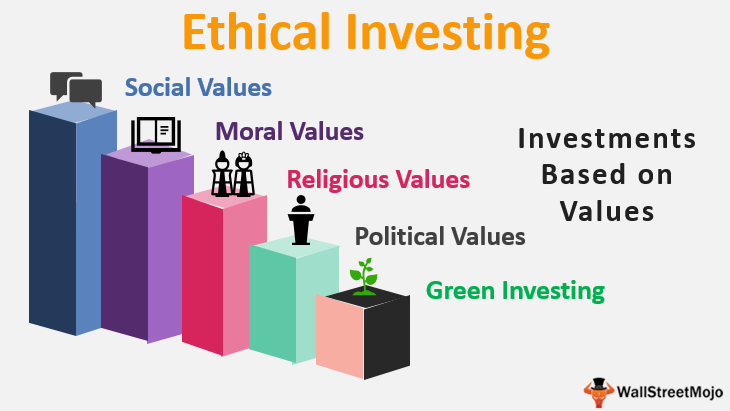

Investing Aligned with Your Values

BENEFICIAL FINANCIAL SERVICES offers wealth management solutions that are aligned with your values allowing you to reach your financial goals

At “Global Beneficial Financial Planning Investing & Asset Management Services” we believe clients can best realize their goals and objectives through the creation of a complete and confidential financial plan. Our approach to wealth management incorporates a thorough analysis of the current situation and the development of strategies and alternatives for review and discussion.

We build customized portfolio strategies for our clients through an in-house research and security selection process, as well as by utilizing high-quality, third-party investment managers with both active and passive strategies and vehicles.

We assist clients in maximizing the after-tax transfer of wealth to beneficiaries and future generations. Importantly, we develop these strategies to ensure the greatest possible flexibility.

Dedicated portfolio managers work with our clients to develop customized, tax-sensitive, multi-asset class strategies to optimize and realize your long-term objectives.

Expertise & Experience

Our partner experienced team of advisors are ready to help clients in US-CA and other all countries to advise with their short-term and long-term goals.

Start investing and watch your money grow over time, tax free

Tax Free Savings Account (TFSA)

A TFSA allows you to set money aside in eligible investments and watch those savings grow tax-free throughout your lifetime. Income, dividends, and capital gains earned in a TFSA are tax-free for life. Your TFSA savings can be withdrawn from your account at any time, for any reason, and all withdrawals are tax-free.

The Benefits of a TFSA

Whether you are new to investing or a seasoned veteran, a TFSA allows you to invest $6000 per year since the age of 18. Watch your investments grow tax-free!

Tax-Free Compounding

Shared Spousal Contributions

Withdrawals Don’t Impact Benefits

Unlimited Withdrawals

Carried Over Contribution Room

No Tax Upon Death

Your family's future is important. Make sure your children are set up for a bright one

Registered Education Savings Plan (RESP)

An RESP is a perfect way for Beneficiars to save for their Childs education. Your money grows tax-free while it is in your RESP. You do not get a tax deduction for the money you put into an RESP. The money that your investment earns while it is in the RESP will not be taxed until money is taken out to pay for your child’s education and is taxed in the child’s name.

The Benefits of an RESP; From government funding to tax benefits, an RESP will help you save for your children’s education and a variety of other educational expenses.

Government Funding

The Government matches 20% of your RESP contributions up to $2,500 each year. The Government will match up to a lifetime maximum of $7,200

Flexible Contributions

You decide when and how much to contribute within the lifetime contribution limit of $50,000 per child. You also decide how you want to invest your funds

Tax-Free Earnings

Earnings accumulate tax-free until you withdraw the money. With a lifetime contribution limit of $50,000 per child until 31 years after you first opened the account

Flexible Expenses

You can use your RESP for a variety of different expenses your child incurs for their education such as tuition, housing, transportation and a variety of other related expenses

Learn how you can benefit with tax-sheltered benefits

Locked in Retirement Account (LRA)

Also known as a Locked-in Retirement Savings Plan (LRSP) in some provinces. If you’re leaving an employer where you were part of a pension plan and would like control of it, you could transfer the commuted (lump sum) value of an employee plan to a LRA/LRSP. It is designed for the accumulation of pension money outside of a pension plan.

The Benefits of an LRA; A LRA has the same tax shelter benefits and can be invested the same as an RRSP however the plan is “Locked” so no additional contributions can be made. Once you retire, withdrawals from the LIRA are able to be made.

Grow Your Savings Tax Free

Your gains in an LIRA are not taxed which allows you to grow your savings tax free!

A Secure & Locked Account

You may not contribute nor withdraw money invested in a LIRA except under certain conditions.

Converts to a Lifetime Income Fund (LIF)

Similar to a RRIF, upon retirement or in the year you turn 71 years of age, you must convert your LRA into a Life Income Fund (LIF)

Retirement is closer than you think.

Registered Retirement Savings Plan (RRSP)

Whether you’re employed or self-employed, an RRSP is an investment vehicle to save money for your exciting retirement. The account can hold a variety of investments such as stocks, mutual funds, GICs, etc, and has significant tax advantages.

The Benefits of an RRSP

An RRSP has many benefits from saving for retirement to tax benefits as you grow! Retirement is closer than you think!

Find out how an RRSP can benefit you

Tax Deductibility

Investors may deduct contributions against their income. For example, if a contributor’s tax rate is 40%, every $100 they invest in an RRSP will save that person $40 in taxes, up to their contribution limit

Tax Sheltered

The growth of your RRSP Investments are tax-sheltered. Unlike Non-RRSP investments, your returns are exempt from any capital gains tax, dividend tax, or income tax. This means that your investments under an RRSP compound at a pre-tax rate.

Tax Deferrals

At the time of your retirement, you are able to withdraw from your account which will typically be taxed at a lower rate than your working years.

Income Splitting

A Spousal RRSP also allows for income splitting at Retirement. A high-earner (spousal contributor) may contribute to a Spousal RRSP in their spouse’s name (the account holder). Since retirement income is divided evenly, each spouse can benefit from a lower marginal tax rate.

Income When You Retire

Once you retire, the RRSP provides you with payments making up your retirement income.

Withdrawals

You can borrow from your RRSP to buy your first home or pay for your education

Saving money for a wedding, vacation or any large expense? A cash account is right for you!

Non-Registered Cash Accounts

Whether you have a specific savings goal in mind, or you simply want your money handy for that ‘rainy day’, a Non-Registered Cash Account can give you access to your money when you need it. This account can easily be opened individually, in joint with another person or for your business.

Benefits of Opening a Cash Account

Unlimited Withdrawals

Withdraw your money quickly and easily whenever you need it.

Individual & Joint Accounts

Opening account for yourself and a spouse or family member?

Personalized Approach

Everyone has different plans and goals, let’s get you on the right track

Cash Balance Plans are IRS-qualified defined benefit pension plans that can help business owners and highly compensated employees accelerate their retirement savings

Cash Balance Plans

Cash Balance Plans can allow contributions up to nearly four times the limit of a 401(k), depending on the business owner’s age. Used in conjunction with a 401(k) plan, business owners can maximize personal contributions while lowering their tax burden. Contributions on behalf of both owners and employees are tax-deductible for the business.

Key benefits of Cash Balance Plans:

Typically higher contribution limits than 401(k) plans or SEPs

Tax-deductible for the business/partnership

Can be used along with other types of plans (such as 401(k)s and profit sharing plans)

Rate of return is set in advance and guaranteed by the business, providing a benefit with market rates of returns to participants

While Cash Balance Plans are not right for every company, they can offer benefits other types of retirement accounts cannot. They can be a good retirement savings vehicle for owners of successful businesses with steady revenues.

A happy retirement is a comfortable one. With the right financial plan, let your money work for you so it is there when you need it

Registered Retirement Income Fund (RRIF)

A RRIF is a comfortable transition because of its similarity to an RRSP. A RRIF provides a high level of control over the investments in your retirement plan, the advantage of tax-free growth of assets within the plan, as well as maximum flexibility in establishing an income stream. By December 31st in the year you turn 71, you must convert your RRSP into a RRIF. This conversion can also be done sooner if you wish.

The Benefits of an RRIF; A steady retirement income is essential to the financially free retirement we all strive for.

RRIF Earnings Are Not Taxable Until Withdrawn

Your RRIF investments and earnings generated are not taxable until they are withdrawn as income. In other words, grow your investments in a tax-free account

Pension Tax Credit on Retirement Income

The growth of your RRSP Investments are tax-sheltered. Unlike Non-RRSP investments, your returns are exempt from any capital gains tax, dividend tax, or income tax. This means that your investments under an RRSP compound at a pre-tax rate.

Controlled Withdrawals

Though an RRIF is specifically catered to retirement, unplanned expenses will come up throughout one’s lifetime. Manage these planned and unplanned expenses with controlled withdrawals.

Investing Aligned with Your Values Made Simple

BENEFICIAL INVESTING manages all portfolios in accordance with the rules determined your ethic values

BENEFICIAL Ethical Solutions For All Types Of Investors

Beneficial Portfolio Access

The premier solution for comprehensive wealth management. Customized solutions from a personal financial advisor.

The Beneficial Portfolio Access service is for clients seeking comprehensive wealth management services who have USD $100,000 or more to invest. Taking a disciplined approach to Beneficial investing, your personal financial advisor creates customized solutions tailored to your individual needs and goals.

Why Express is right for you

Our express service allows younger and newer investors to easily start their investing journey and begin building their wealth in a values indexed manner.

Talk to an Advisor

Start With Only $1000

Safe & Secure Platform

Work With a Licensed Professional to Build Your Portfolio

Lower Fees

Recurring Deposits Option

Opening an account has never been easier! Please fill out the form here and an advisor will be in touch to walk you through the process!

Still have some further questions?