DEVELOPING ALTERNATIVE FINANCIAL INSTRUMENTS WITH CONFIGURING

Shariah compliance is one of the major challenges facing Muslims and Islamic institutions. In the securitization of assets, Islamic financial institutions initiate separate special purpose vehicles in order to indirectly engage in interest-based transactions.

IJARA-LEASEBACK CONFIGURING

The Islamic financing model has found that one solution is to use a trust to avoid paying interest on money borrowed directly. In this process, an individual trust takes ownership of the property and the technique is called “Lease to Buy” (Ijara wa Iqtina).

A configuring essentially changes the nature of the transaction from a rent-on-money transaction (Riba) to buy-sell or rent-on-property (murabaha or Ijara-leaseback) transaction. We provide of configuring for conversational mortgage-holders that are already happy with their rates and terms of their currently mortgage, but just want to convert it to be sharia-compliant.

We can structure not only the Mortgage loans you have previously received, but also your new Mortgage financings in this model.

You can choose the mortgage lender or bank with the most suitable terms for you.

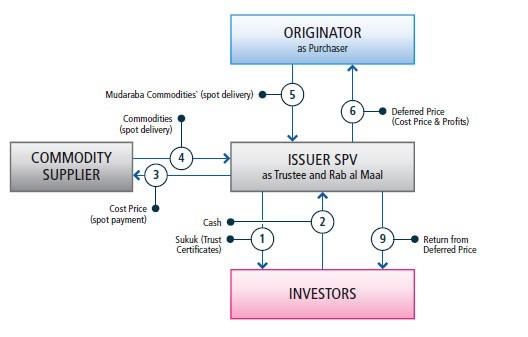

TAWARRUQ (MONETIZATION)

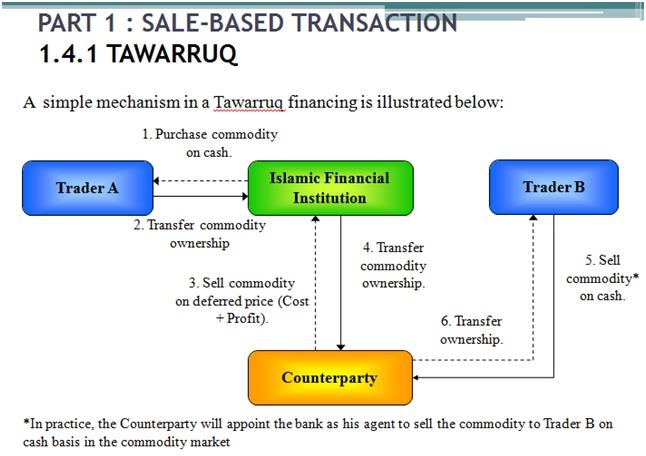

Lenders and Banks become the investor (buy-sell-lessor) of your assets. An example is the Tawarruq (monetization) financing through Special purpose vehicle. The SPV servicing it as a backdoor to engage in prohibited transactions.

Tawarruq is an arrangement whereby a person, in need of liquidity, purchases a commodity from a seller on credit at a higher price (to buy on credit and sell at spot value)

Majority of the Hanbali jurists have preferred the version according to which ‘tawarruq’ is permissible. The Shafi’i jurists have allowed ‘Inah’, and therefore it seems that ‘Tawarruq’ is permissible with them with a greater force.

Maliki jurists are it appears from their books that they do not see a problem in ‘Tawarruq’.

Thus, the preferred view in all the four schools of Islamic fiqh is that Tawarruq is permissible.

A special purpose vehicle can be a “bankruptcy-remote entity” because the operations of the entity are restricted to the purchase and financing of specific assets or projects.

The typical legal forms of special purpose vehicles are partnerships, limited partnerships, or joint ventures.

Tawarruq and Murabaha: What’s the difference?

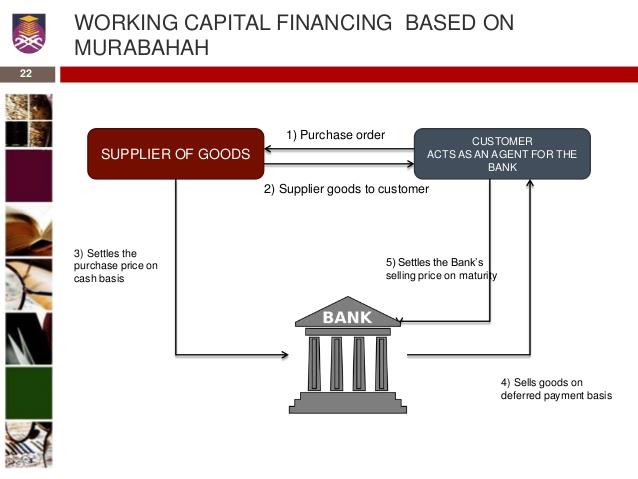

Murabaha – The bank purchases goods on behalf of a customer

One example of this is Murabaha. Here, a bank will purchase goods on behalf of a customer – such as a new car, furniture, electronics or a home – and then sell them to the customer at a profit. The profit, added to the customer’s monthly installments, is referred to as a profit rate. It is very similar in structure to a “rent to own” arrangement as the intermediary retains ownership of the goods or property until the loan is paid in full.

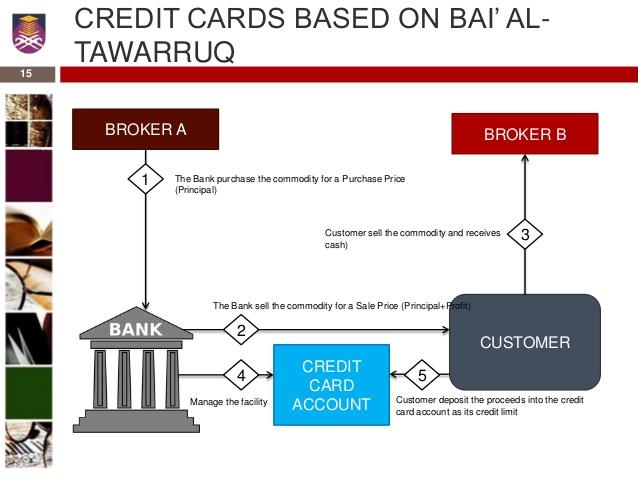

Tawarruq – Is commodity Murabaha

Another concept often used in the Islamic banking industry is Tawarruq. This is a development of Murabaha and is sometimes referred to as commodity Murabaha or reverse Murabaha as it involves having access to cash through the trading of a commodity in a real transaction.

There are two main steps involved in Tawarruq; first is the Murabaha stage where the bank and the customer enter into a commodity Murabaha contract – this could be where a bank buys shares or commodities on behalf of the customer and then leases them back to the customer. The customer then owns – either physically or constructively – the assets subject of the Murabaha contract. The second step in this process is the asset liquidation stage – where customers can choose to either sell or liquidate the assets via an agency agreement through the bank.

Which one is used, when?

Generally, Tawarruq is permitted for those transactions that cannot be fulfilled through other Islamic Banking means such as giving a customer access to cash for the financing of intangible personal needs. These can include short-term needs such as travel, education or renovating a home – or just to give a customer some cash to resolve a cash flow crisis. Murabaha, on the other hand, is generally used for longer-term loans such as the purchase of a house or car.

However, it can be confusing for customers as to which personal finance product falls under which concept. Traditionally, Tawarruq was a transaction that involved three parties (the bank, the customer and the broker) and Murabaha involved four (the bank, the customer, broker one and broker two). But these terms have merged as scholars requested that most three party-transactions be enhanced to four – making the difference between the two very blurred. Among many scholars today, the terms are virtually interchangeable.

CONFIGURING WITH SPECIAL PURPOSE VEHICLE

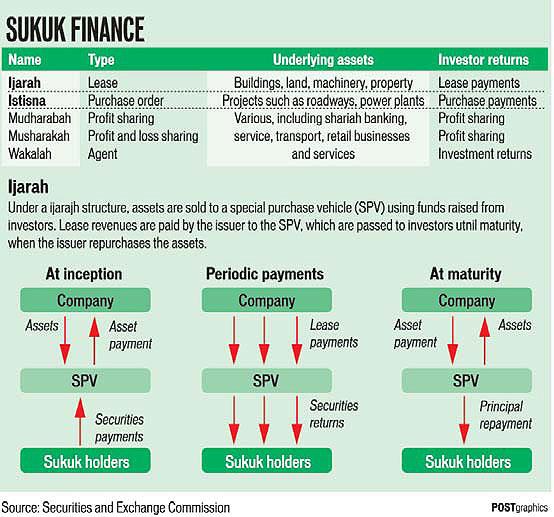

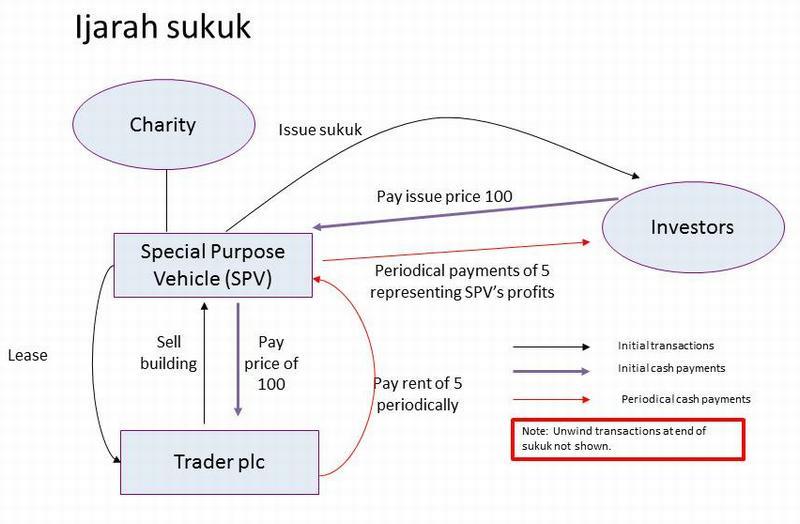

Sukuk Al-Ijarah is a Shariah compliant lease. Sukuk Al-Ijara is mostly widely financed through a SPV. The Originator, the Issuer SPV and the investors are three main parties involved in the securitization of an asset through the SPV.

For example, a customer orders an asset. The INVESTOR establishes an SPV. The Special Purpose Vehicle funds the asset through issuance of certificate of ownership to investors. Once the asset is bought and transferred to the customer under Ijarah Muntahia bi Tamleek, periodic rental payments made by the client throughout the rental period serve as the principal and return to the investors.

Configuring with SPV

1-For Realizing a new project, Developing a current project or any commercial operation …

2-For Purchase-Selling operations of Commercial Commodities and Services …

3-For the operations of Renting and Usufruct ….

4-For the Rights and Possession of Property ….

Uses of Special Purpose Vehicles

The following are the most common reasons for creating SPVs:

1.Risk sharing

A corporation’s project may entail significant risks. Creating an SPV enables the corporation to legally isolate the risks of the project and then share this risk with other investors.

2.Securitization

Securitization of loans is a common reason to create an SPV. For example, when issuing mortgage-backed securities from a pool of mortgages, a bank or agents can separate the loans from its other obligations by creating an SPV. The SPV allows investors in the mortgage-backed securities to receive payments for these loans before other creditors of the bank.

3.Asset transfer

Certain types of assets can be hard to transfer. Thus, a company may create an SPV to own these assets. When they want to transfer the assets, they can simply sell the SPV as part of a merger and acquisition (M&A) process.

4.Property sale

If the taxes on property sales are higher than the capital gain realized from the sale, a company may create an SPV that will own the properties for sale. It can then sell the SPV instead of the properties and pay tax on the capital gain from the sale instead of having to pay the property sales tax.

5.Benefits:

- Isolated financial risk Direct ownership of a specific asset

- Tax savings, if the vehicle is created in a tax haven such as the Cayman Islands or another offshores Easy to create and set up the vehicle

The optics surrounding SPVs are sometimes negative

A Special Purpose Vehicle (SPV) is a subsidiary company that sits underneath a parent company and is set up for numerous reasons.

SPVs can be used to mitigate risk. If its parent company was to become bankrupt the assets held by the SPV would be protected.

SPVs can also be used to raise capital for its parent company at a favorable borrowing rate. In addition to this other benefits include the ability of the SPV being able to operate in any jurisdiction while being based in an attractive jurisdiction that fits best from a regulatory perspective.

The Special Purpose Vehicle (SPV) is a crucial financial tool in the implementation of the sukuk or investment financing.

Under a sukuk or investing assets security based on a tangible asset, the SPV is created by the originator, which holds the assets in question to protect them from creditors if the originator has financial troubles.

Then the SPV will issue a sukuk security to raise funds for the purchase of the asset.

The SPV passes the offering to the originator that will make the purchase of the asset before the SPV purchases the asset from the originator.

Acting as the trustee for the holders of the sukuk or investment products, the SPV leases the assets back to the originator who then pas investment instruments sed on the income from the lease to the sukuk-holders.

Finally, at the point of maturity of the sukuk or investment assets, the originator buys back the asset at a nominal price.

What is an Islamic Forex account?

Forex trading is increasingly accessible and the potential for quick money draws more traders in every day. An Islamic Forex account is a halal trading account that is offered to clients who respect the Quran and wish to invest in the Islamic stock market following the principles of Islamic finance.

Also known as swap-free accounts, Islamic trading accounts differ in several ways from regular Forex accounts. As Sharia law prohibits the accumulation of interest, traders with Islamic accounts do not pay or receive interest rates. In addition, transactions in accounts based on Islamic finance must be carried out without delay, so currencies must be transferred from one account to another immediately, and transaction costs must also be paid at the same time.

In general, these accounts are quite similar to traditional trading accounts, only some specific elements have been adapted to meet the fundamental principles of Islamic finance.

How to open an Islamic Forex account?

No fees in the form of interests apply for Islamic accounts. The fee for rolling over a position to the next trading day (rollover fee) in the Forex market may be used as an example of this interest payment, which is made at the time of carrying over an open position to the next trading day. The rollover fees are not charged on Islamic Forex accounts.

To open an Islamic Forex account, Muslim customers must register and open an Trade.MT5 account, and provide the necessary documents to open a halal trading account.

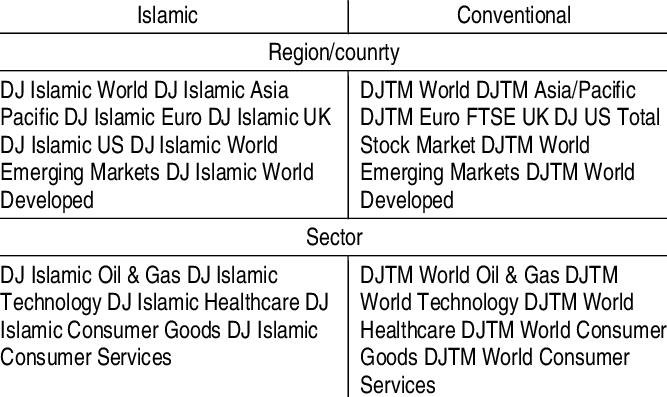

The Dow Jones Islamic Market Index (DJIM),

The Dow Jones Islamic Market Index (DJIM), launched in 1999 in Bahrain, was the first index created for investors seeking investments in compliance with Muslim Sharia law.

The DJIM has an independent Shari’ah (Islamic Law) Supervisory Board. The DJIM screens have been adopted by the Accounting and Auditing Organization for Islamic Financial Institutions (“AAOIFI”)-Standard 21. ‘ The DJIM measure the performance of a global universe of investable equities that have been screened for Shari’ah compliance consistent with Dow Jones Indexes’ methodology. The selection universe for the DJIM family of indexes is the same as the universe for the Dow Jones World Index, a broad-market index that seeks to provide approximately 95% market coverage of 44 countries.

The first level of DJIM screening removes companies involved in such products alcohol, pork-related products, conventional financial services (e.g. banks and insurance companies), entertainment (e.g. hotels, casinos, gambling etc.), tobacco, and weapons and defense. A second level of DJIM screening based on financial ratios, is intended to remove companies based on debt and interest income levels in their balance sheets.

Cryptocurrencies have been one of the biggest investment opportunities globally.

Investing and/or using Cryptocurrencies like Bitcoin or Ethereum is Halal, as is staking them — so long as you aren’t gambling with your money and doing so irresponsibly with debt; however placing your cryptocurrency on interest-bearing platforms such as Celsius or Blockfi, or a decentralized platform such as Aave isn’t nessecarily Halal.

Ultimately all the big coins, such as Bitcoin, Ethereum, Dogecoin, Polkodot, Monero, Chainlink, are as well.

Other countries, such as the UAE and Malaysia have issued their own cryptocurrencies which are backed by physical gold. An example is the OneGram cryptocurrency by the UAE which is available here on Binance.

Islamic financial institutions are increasingly using blockchain technology for complex financing terms, Shariah-compliant transactions and Islamic and sharia-compliant alternatives to conventional insurance. Blockchain can assist in KYC, back-office automation, and underwriting of micro-insurance.

Several Islamic Financial Institutions are Trying Blockchain. Emirates Islamic was the first Islamic bank to test blockchain. It is part of the UAE’s Emirates NBD banking group. As early as 2017 the bank integrated the technology into cheque-based payment processes. This strengthened their authenticity and minimized the potential for fraud.

The UAE-based Al Hilal Bank became the world’s first Islamic Bank to complete a sukuk transaction on the blockchain on the Abu Dhabi Global Market Financial center.

Based on the Ethereum blockchain, the system was developed by Dubai-incubated fintech startup Jibrel Network.

Benefits and Risks of Halal Investing

Investing according to Islamic principles can offer many benefits to Muslims and non-Muslims alike. Halal investing encourages a disciplined investment process that promotes in-depth security research and monitoring.

Islamic scholars have established financial guidelines to determine when a business activity is a core source of revenue and when it is not. For example, the “five percent rule” says that a core business activity is one that accounts for more than five percent of a company’s revenue. This reasoning applies to the Islamic prohibition on riba, or interest, as well. If a company’s interest-based income or holdings exceed certain limits, then investing in the company is forbidden.

Most Scholars are in agreement that if the company only deals in a fraction of un-Islamic goods and services then you may still invest. It is suggested that you simply give away the percentage of the profits that are created by the haram section of the business. So, if 5 or 10% of the company’s profits stem from alcohol, you’d donate 5 or 10% of your profits to a charity.

Final Word

There will always be a divide in opinion as to whether day trading is halal or haram. It must also be noted that despite in-depth research into numerous sources, this page is not trying to offer readers religious advice. Instead, it looks to collate viewpoints and present them in an easy-to-digest format.

Whilst there certainly remains a substantial number of people who conclude Islamic day trading is halal, perhaps the best steps you can take are to choose your broker carefully and evaluate your trade decisions with the parameters of halal in mind