CONFIGURING

SHARIA COMPLIANT FINANCE STRUCTURING

Why?

In countries where traditional banking, investment, finance and insurance sectors are very developed, people generally buy products and use loans from these financial and insurance institutions, and Islamic banking is not very common, we present our STRUCTURING studies for your evaluation.

How?

Our STRUCTURING consultancy works; Trust, SPV, Agent Special Vehicles and Leaseback- Murabaha-Ijara-Mudaraba, Buy/Sell/Lease and Tawarruq (monetization) financing methods, which are compatible with Islamic finance models and criteria, are made.

We provide configuration for individuals who are satisfied with the financial product-credit-insurance plan ratios and conditions of financial institutions in the market, but want to make it compliant with Sharia.

Advantages

You don’t have to go through a tedious refinancing process; No credit check, assessment or proof of income required. This is not a refinancing, but a restructuring of your transaction.

The entire process only takes 7 business days and in most cases we can complete the configuration before your next payment is due. The best part: It costs significantly less than refinancing, aside from freeing yourself from Riba.

There is also what is called a successor beneficiary that can only obtain the property if you pass away. Many people add on this beneficiary if they have children, so that the property will automatically to their children without having to have a will.

EXACTLY WHAT HAPPENS IN THE CONFIGURATION?

The first rule in Islamic finance is the contract-contract, which indicates the intention to buy-sell-rent the assets or services you need. Our structuring method also changes the nature of the transaction with purchase-sale-leaseback or lease (murabaha and Ijara applications) contracts and practices.

The main transactions of the financial institutions that own the purchased or used financial product shall not be interfered with.

No Risk.

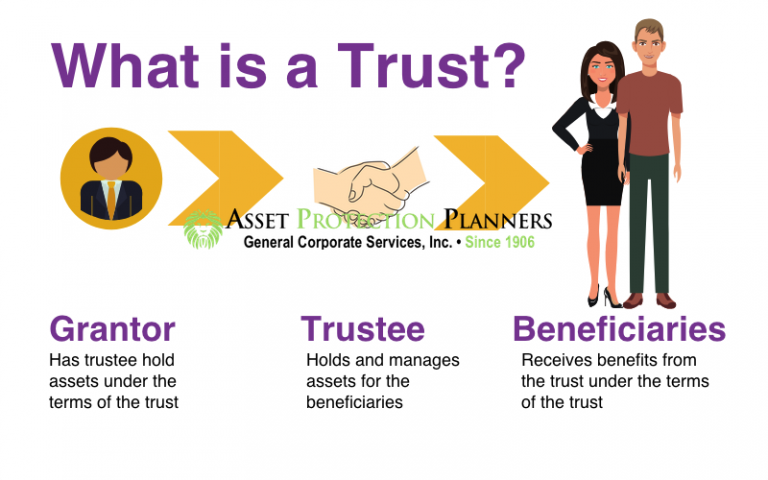

You will legally transfer the financial products you have purchased or will receive (100% owned by you) to your TRUST pool.

If you want to sell the house; Before the closing of the selling of the house, all the title and ownership will be transferred to you, and then transferred to the buyer. So on paper you will be the one selling the property. You will be required to pay off whatever is left on your loan balance. A profit gained from the sell is 100% yours.

Everything is Lawful

It will be very beneficial for you to protect the title deed of the real estate you bought with the mortgage, your loan agreements or insurance plans in this Trust. As you are the donor and beneficiary of this Trust, you have the same rights as a regular landlord. Thus, you can sell, transfer, lease or renew the assets in Trust as you wish.

Since you are the one giving the trust, you have full authority when you want to sell/rent/transfer.

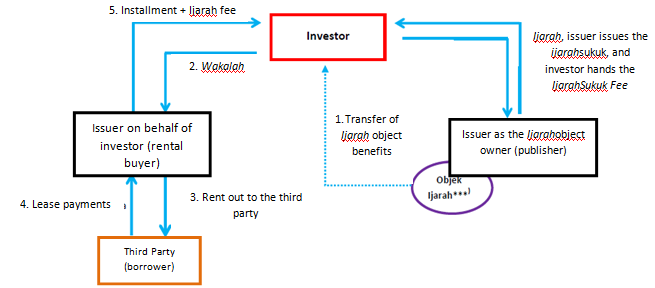

Lenders/banks/funds/Insurance companies will continue to be investors, but you will no longer pay Riba. After configuration, your transaction will be restructured as an owned lease (Ijara) or buy-sell (Murabaha) transaction between you and the trust.

You will make payments to the Trust in return for the assets, loans, plans you have transferred to the Trust. Bank or insurance companies will be investors in the transaction and will receive their investment and receivables from the Trust.

Trust holders will authorize the Trust to pay for financial institutions (as purchase-sale-rent-use fee). The bank will invest in your assets and generate its profits through trading, such as renting or trading; they will earn their income not by money (riba), but by halal way.

We can structure not only the mortgage and other loans and insurance services you have previously received, but also your new financial needs in this model.

You can always choose the institutions, bank or insurance companies that provide mortgage loan and insurance services on the most suitable terms for you.

You do not need approval as you will be approved by banks or insurance companies for the configuration, after you open your private Trust, you will be able to legally make purchase-sale-lease-transfer-attorney contracts online.

What types of real estate and loans, banks, insurance and investment products can be placed in custody for the Islamic Finance structuring?

1- The real estate subject to the mortgage (house, flat, summer house, vacant land, timeshare with title deed, etc.)

2- Financial Accounts (bank accounts, brokerage accounts, mutual funds, etc.)

3- Loans Received (Individual-Business-Commercial loans)

4- Printed Stock or Bond Certificates (Individual stocks and bonds represented by paper certificates in publicly traded companies)

5- Business Interests (proprietary rights such as sole proprietorships, partnerships, affiliated companies, LLCs, etc.)

6- Contractual Interests (copyrights, commissions, etc.)

7- Life Insurance Plans, Contracts and Income (income from whole life or term life policies)

8- Retirement Account Plans, Contracts and Income (salary income, 401k or 403b etc.)

9- Insurance Products/Plan contracts (Vehicle, Health, Life, Pension, Work and other)

10- Personal Property (art, jewelery, furniture, collectibles, etc.)

11-Owned vehicles

12-Commercial Warehouse Ownership or Rental Contracts

13- Other assets, plans, contracts and income

Information about beneficiaries (family, friends, charities) who will receive escrow property when you transfer/sell assets in the Trust or when you die;

There are three types of gifts you can specify that you can create in the Living Trust, established for the purpose of Islamic Finance Structuring:

General Gifts

The percentage of property remaining to beneficiaries (family, friends, charities) after any special gifts and charitable cash gifts are given is determined in the Trust contract.

Special Gifts (optional)

Personal items (jewelry, heirloom, artwork, etc.) or cash to be given to family or friends can be determined.

Charitable Gifts (optional)

Cash gifts or other items to be given to charities can be determined.

What happens to the goods placed in trust when the goods to be registered are transferred or the first spouse dies?

When the goods to be registered are transferred or one of the spouses dies, the entrusted property is essentially divided into two.

There are several options for how to handle part of the deceased spouse's property.

The surviving spouse receives the deceased spouse's assets without any restrictions.

The surviving spouse will be able to use the property share of the deceased spouse. However, in the event of the death of the surviving spouse, that property must pass to the right holders bearing the other spouse's name.

The share of the deceased spouse from the property will be given to more than one person.

Please send a message to learn more about these options. https://globalfinanceplatform.com/contact/

What will be the Configuration application in accordance with Islamic Criteria about Insurance Services?

What are the Islamic principles adopted by Islamic Insurance- Takaful?

Tabarru' (Donation): In takaful business, tabarru' is a donation for the purpose of mutual protection among the participants. Tabarru' is credited from the Participant Investment Fund (“PIF”) to the Participant Risk Fund (“PRF”) which will be used to help other participants in the event of any misfortune.

Wakalah: Wakalah (agency) contract in takaful business refers to a contract established between the Certificate Holder and the Operator -Adviser where the Certificate Holder appoints the Operator as a wakeel (agent) to manage the takaful funds on behalf of the Certificate Holder in accordance with the shariah principles. As a wakeel, the operator is entitled to a wakalah (agency) fee for executing two (2) main tasks: managing the takaful funds, namely Participant Investment Fund (PIF) and Participant Risk Fund (PRF); and facilitating the investment of the takaful funds.

Ta'awun: Ta'awun means corporation or solidarity (based on the spirit of brotherhood, righteousness and piety). In takaful context, ta'awun is referred to as mutual help and indemnity where the participants are committed to making donations with the intention to help each other against any defined perils within the Takaful scheme.

We structure the following insurance services to be utilized according to these criteria.