GLOBAL BENEFICIAL FINANCING-GBF

Alternative-Ethic-Safe-Profitable-Beneficial-Islamic (free of interest) financial instruments is a centuries-old practice that is gaining recognition throughout the world and whose ethical nature is even drawing the interest of all investors.

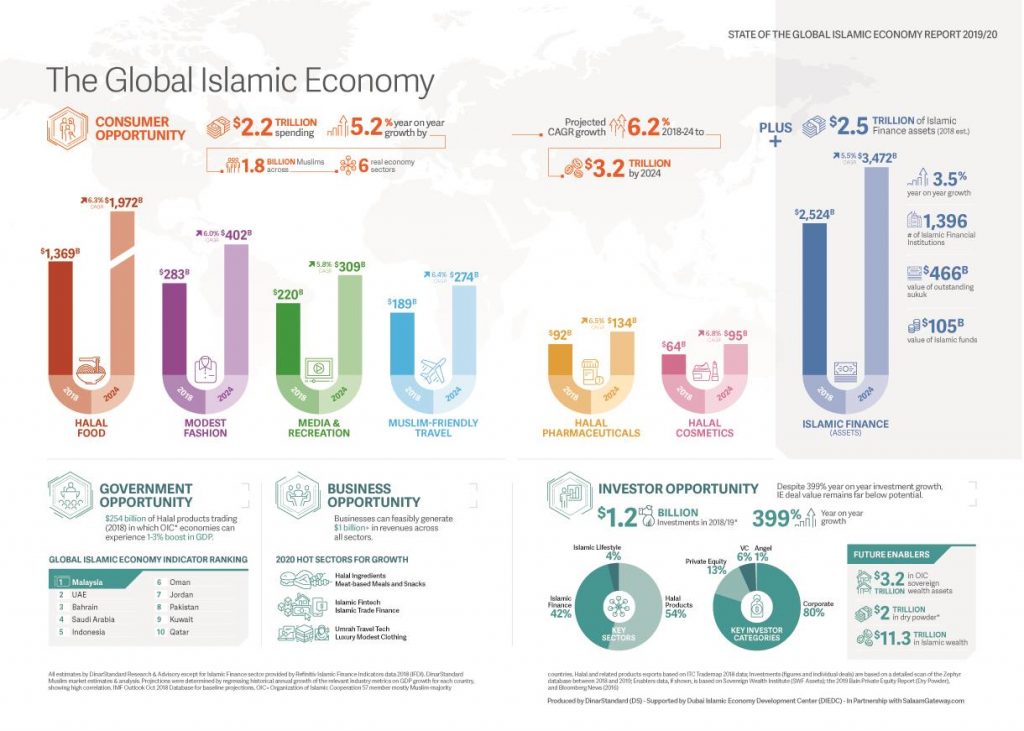

Islamic finance is a way of doing financial transactions while respecting Islamic law or sharia. Islamic finance today is a $2.5 trillion industry with hundreds of specialized institutions located in more than 80 countries. Global Islamic Finance assets are forecast to reach USD 3.69 trillion by 2024

While adhering to the ethical principles of the Muslims and other all peoples, “GLOBAL BENEFICIAL FINANCING” is helping all consumers achieve their goal of home and commercial real estate ownership or car, education or trade financing gain protections and competitive benefits such as INTEREST FREE LOANS.

There is a similar Jewish law that prohibits Jewish individuals from charging interest to other Jews. Active and successfully operating in all 50 states in the US, GBF, It also provides ‘Sharia structuring’ service for the financial needs of its customers in countries other than the USA.

Fannie and Freddie Are Investors in Islamic Mortgages

- US government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac that guarantee most of the mortgages made in the U.S. invest in these loans

- Allowing smaller banks and lenders to offer them to customers

- Default rates are probably lower than other mortgages

- Due to the straightforward terms Read More

Similar Rules Apply to Those of Jewish Faith

There is a similar Jewish law that prohibits Jewish individuals from charging interest to other JewsThere is a similar Jewish law that prohibits Jewish individuals from charging interest to other Jews

We provide Configuring for conversional mortgage-holders that are already happy with their rates and terms of their currently mortgage, but just want to convert it to be sharia-compliant

Fintech supported Global Benefıcıal Fınancıng-GBF is a Sharia structuring Consultancy.

Ethical, fair, efficient Fintech solutions combine Interest Free (NIB) trading with Sharia Compliant Contracts and meet AAOIFI (Islamic Accounting and Auditing Institution) standards.. .

We are constantly working with the professional Sharia advisory board and supervisory board to simplify the access and application process to Islamic finance ethical criteria.

We can assist with purchasing a home and commercial real estate, automobile, educational or commercial property or replacing an existing mortgage by offering alternative options for Islamic finance

We believe in educating and enlightening consumers on various Islamic finance options because we believe educated consumers make the best decisions.

GBF services and alternative products that are active and successfully operating in the US and other countries are Shariah-compliant for residential, commercial real estate or refinancing. If you need a reliable partner to help you make such important decisions that comply with all Islamic laws, GBF may be the right choice for you.

Global Beneficial Financing-GBF offers the following benefits:

- Fits traditional legal US and International banking systems

- Complies with Sharia or Islamic law

- Frees you from Riba

- Offers competitive financing options

- It also provides ‘sharia configuration’ service to its customers in countries other than the USA.